UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Powerfleet, Inc.

123 Tice Boulevard

Woodcliff Lake, New Jersey 07677

NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on September 16, 2025

To the Stockholders of Powerfleet, Inc.:

Notice is hereby given that the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Powerfleet, Inc., a Delaware corporation (the “Company,” “we,” “our” or “us”), will be held on Tuesday, September 16, 2025, at 10:00 a.m., Eastern Time, and thereafter as it may be postponed or adjourned from time to time. We will be holding our Annual Meeting in a virtual meeting format only. You may attend, vote and submit questions during the Annual Meeting via the Internet at www.meetnow.global/MPNP7AR. We have designed the format of the Annual Meeting to ensure that you are afforded the same rights and opportunities to participate as you would at an in-person meeting, using online tools to ensure your access and participation.

We have scheduled the Annual Meeting for the following purposes, each of which is described more fully in the Proxy Statement accompanying this Notice of Annual Meeting:

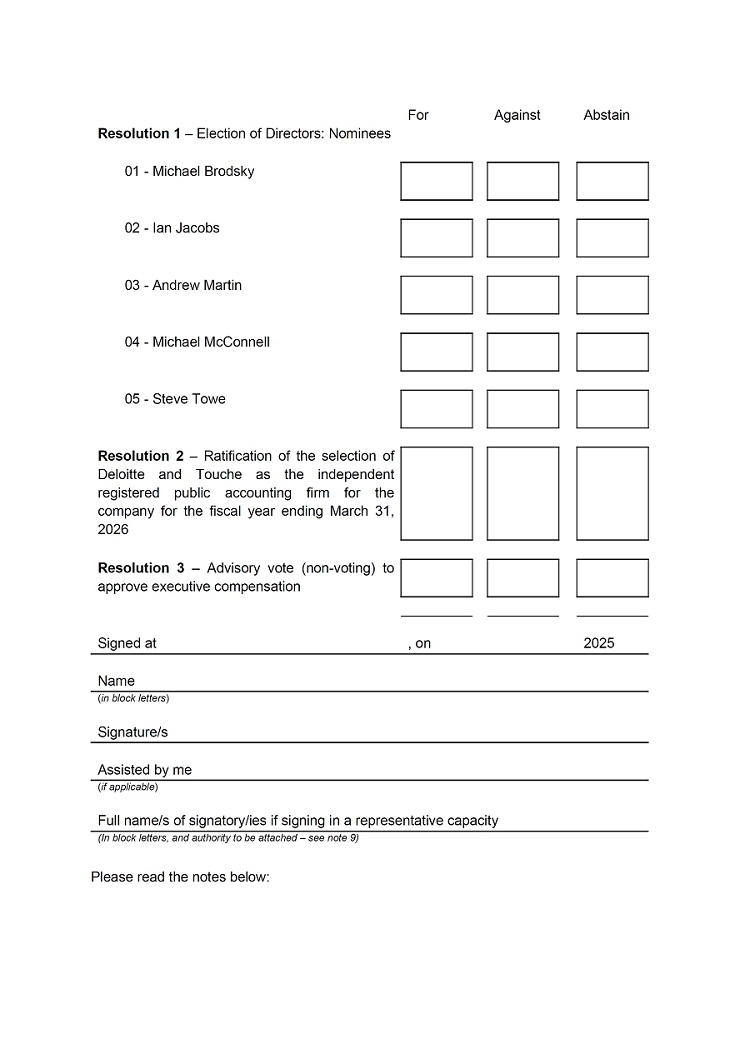

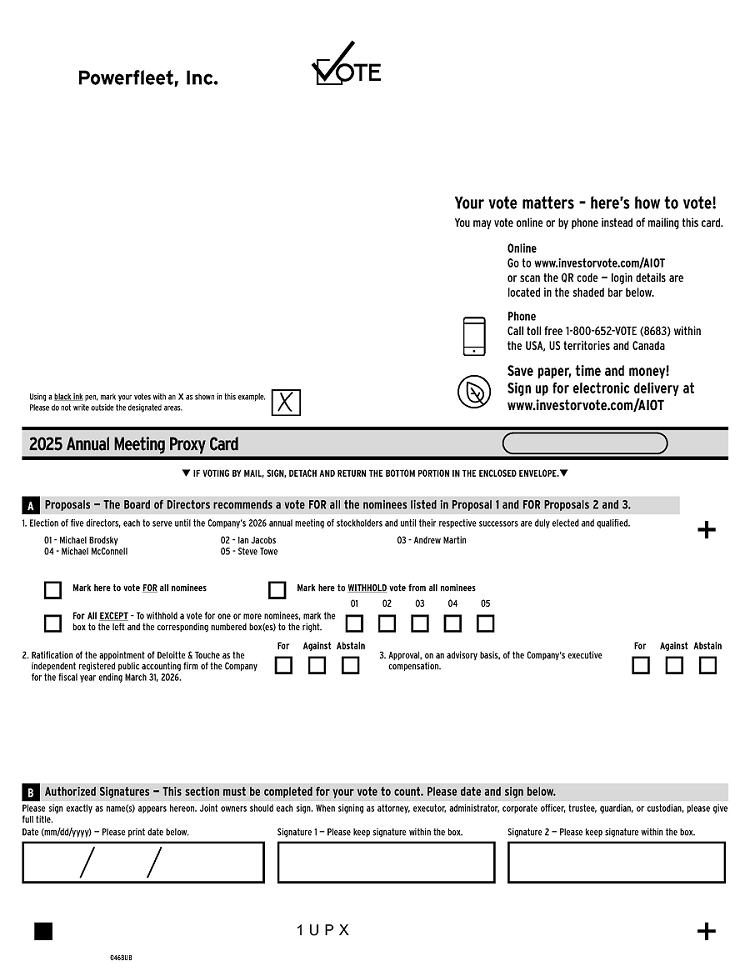

| 1. | To elect five (5) directors, the names of whom are set forth in the accompanying Proxy Statement, each to serve until the Company’s 2026 annual meeting of stockholders and until their respective successors are duly elected and qualified; | |

| 2. | To vote upon the ratification of the appointment of Deloitte & Touche as the independent registered public accounting firm of the Company for the fiscal year ending March 31, 2026; | |

| 3. | To hold an advisory (non-binding) vote to approve the Company’s executive compensation; and | |

| 4. | To transact such other business as may properly come before the Annual Meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary, or before any adjournment thereof. |

The meeting will begin promptly at 10:00 a.m., Eastern Time. Only holders of record of shares of our common stock at the close of business on July 25, 2025, the date fixed by our Board of Directors as the record date for the Annual Meeting, will be entitled to notice of, and to vote at, the meeting and any postponements or adjournments of the meeting.

For a period of at least 10 days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the meeting will be available and open to the examination of any stockholder for any purpose germane to the Annual Meeting during normal business hours at our principal executive offices located at 123 Tice Boulevard, Woodcliff Lake, New Jersey 07677.

Your vote is important. Whether you expect to attend the virtual Annual Meeting or not, please vote your shares by Internet or by mail pursuant to the instructions included on the proxy card or voting instruction card. If you attend the Annual Meeting, you may vote your shares over the Internet, even though you have previously signed and returned your proxy.

| By order of the Board of Directors, | |

| /s/ Steve Towe | |

| Steve Towe | |

| Chief Executive Officer | |

| Dated: July 29, 2025 | |

| Woodcliff Lake, New Jersey |

Important Notice of Internet Availability of Proxy Materials for the 2025 Annual Meeting of Stockholders to be held on September 16, 2025. The Notice, this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended March 31, 2025 (our “2025 Annual Report”) filed with the Securities and Exchange Commission (“SEC”) on June 26, 2025 are available through the Internet at https://ir.powerfleet.com/proxy-materials. Under SEC rules, we are providing a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) to notify you of the availability of our proxy materials on the Internet. The Notice of Internet Availability instructs you on how to access and review this Proxy Statement and our 2025 Annual Report. The Notice of Internet Availability also instructs you on how you may authorize a proxy to vote your shares over the Internet and provides instructions on how you can request a paper copy of these documents if you desire, and how you can enroll in e-delivery. If you received your annual meeting materials via email, the email contains voting instructions and links to this Proxy Statement and our 2025 Annual Report on the Internet.

| 2 |

POWERFLEET, INC.

123 TICE BOULEVARD

WOODCLIFF LAKE, NEW JERSEY 07677

PROXY STATEMENT

Annual Meeting of Stockholders

September 16, 2025

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Powerfleet, Inc., a Delaware corporation (“Powerfleet,” the “Company,” “we,” “our” or “us”), for use at our 2025 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, September 16, 2025, at 10:00 a.m., Eastern Time, and any adjournments or postponements thereof. We will be holding our Annual Meeting in a virtual meeting format only. You may attend, vote and submit questions during the Annual Meeting via the Internet at www.meetnow.global/MPNP7AR. We have designed the format of the Annual Meeting to ensure that you are afforded the same rights and opportunities to participate as you would at an in-person meeting, using online tools to ensure your access and participation.

The Board is sending a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) relating to the Annual Meeting to the Company’s stockholders beginning on or about August 7, 2025. The Notice of Internet Availability instructs you on how to access and review this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended March 31, 2025 filed with the Securities and Exchange Commission (the “SEC”) on June 26, 2025 (our “Annual Report”). The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our named executive officers and our directors, and certain other required information.

Important Notice of Internet Availability of Proxy Materials for the 2025 Annual Meeting of Stockholders to be held on September 16, 2025

The Notice of Internet Availability, this Proxy Statement and our Annual Report are available through the Internet at https://ir.powerfleet.com/proxy-materials. Under SEC rules, we are providing the Notice of Internet Availability to notify you of the availability of our proxy materials on the Internet.

Record Date and Outstanding Shares

The Board has fixed the close of business on July 25, 2025 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the meeting. Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting or any and all adjournments or postponements thereof.

As of the Record Date, we had issued and outstanding 133,443,292 shares of common stock. Our common stock comprises all of our issued and outstanding voting stock.

For a period of at least 10 days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the meeting will be available and open to the examination of any stockholder for any purpose germane to the Annual Meeting during normal business hours at our principal executive offices located at 123 Tice Boulevard, Woodcliff Lake, New Jersey 07677.

Purposes of the Annual Meeting

The purposes of the Annual Meeting are (i) to elect five (5) directors to our Board, each to serve until our 2026 annual meeting of stockholders and until their respective successors are duly elected and qualified; (ii) to ratify the appointment of Deloitte & Touche as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2026; (iii) to approve, on an advisory basis, the Company’s executive compensation; and (iv) to transact such other business as may properly come before the Annual Meeting or at any adjournment or postponement thereof. In addition to the foregoing, there will be a report on the progress of our Company and an opportunity for questions of general interest to the stockholders.

| 3 |

Unless we receive specific instructions to the contrary or unless such proxy is revoked, shares represented by each properly executed proxy will be voted: (i) “FOR” the election of each of our nominees as a director; (ii) “FOR” the ratification of the appointment of Deloitte & Touche as our independent registered public accounting firm for the fiscal year ending March 31, 2026; (iii) “FOR” the approval, on an advisory basis, of our executive compensation; and (iv) with respect to any other matters that may properly come before the Annual Meeting, at the discretion of the proxy holders. We do not presently anticipate that any other business will be presented for action at the Annual Meeting.

Virtual Meeting Format

Attending and Participating at the Virtual Annual Meeting

We will be holding our Annual Meeting in a virtual meeting format only. If you are a stockholder of record as of the close of business on July 25, 2025, you may attend, vote and ask questions by typing them into the dialog box provided during the meeting by logging into the meeting at www.meetnow.global/MPNP7AR.

Rationale for the Virtual Format

We have decided to hold our Annual Meeting in a virtual meeting format only. We believe that hosting a virtual meeting will facilitate stockholder attendance and participation by enabling stockholders to participate from any location around the world, improve our ability to communicate more effectively with our stockholders, provide for cost savings to us and our stockholders, and reduce the environmental impact of our Annual Meeting. We have designed the virtual meeting to provide substantially the same opportunities to participate as you would have at an in-person meeting. We are providing opportunities to submit questions prior to the meeting to enable us to address appropriate questions at the Annual Meeting.

Voting at the Annual Meeting

Quorum Requirements

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the total outstanding shares of our common stock is necessary to constitute a quorum for the transaction of business at the meeting. Virtual attendance at the Annual Meeting constitutes presence in person for purposes of quorum at the meeting. Abstentions and broker “non-votes” (as hereinafter defined) are counted as present and entitled to vote for purposes of determining whether a quorum is present. A broker “non-vote” on a matter occurs when a broker, bank or your representative may not vote on a particular matter because it does not have discretionary voting authority and has not received instructions from the beneficial owner.

Stockholders of Record and Beneficial Owners

Each share of our common stock outstanding on the Record Date will be entitled to one vote on each matter submitted to a vote of our stockholders. Cumulative voting by stockholders is not permitted. The shares to be voted include shares of our common stock that are (i) held of record directly in a stockholder’s name and (ii) held for stockholders in “street name” through a broker, bank or other nominee. If your shares are registered directly in your name with the Company’s stock transfer agent, Computershare Inc. (“Computershare”), you are considered the “stockholder of record” with respect to those shares. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of those shares.

| 4 |

If you hold your shares of our common stock through a broker, bank or other representative, generally the broker, bank or representative may only vote the common stock that it holds for you in accordance with your instructions. However, under the rules that govern brokers who have record ownership of shares that are held in street name for their clients who are the beneficial owners of the shares, brokers have the discretion to vote such shares on routine matters. Therefore, if the broker, bank or representative has not timely received your instructions, it may vote on certain matters for which it has discretionary voting authority. The ratification of the appointment of an independent registered public accounting firm is considered a routine matter. Thus, if you do not otherwise instruct your broker, the broker may turn in a proxy card voting your shares “FOR” ratification of the independent registered public accounting firm. The Company believes that all of the other proposals to be voted upon at the meeting will be considered “non-routine.” Thus, a broker or other nominee cannot vote without instructions on these non-routine matters, and, consequently, if your shares are held in street name, you must provide your broker or nominee with instructions on how to vote your shares in order for your shares to be voted on those proposals.

Holders of our common stock will not have any rights of appraisal or similar dissenters’ rights with respect to any matter to be acted upon at the Annual Meeting.

Vote Required

For the election of directors, a plurality of the votes cast is required. Since the number of candidates does not exceed the number of vacancies, receipt of any votes in favor of any candidate will ensure that that candidate is elected. If no voting direction is indicated on a proxy card that is signed and returned, the shares will be considered votes “FOR” the election of all director nominees set forth in this Proxy Statement. In accordance with Delaware law, stockholders entitled to vote for the election of directors may withhold authority to vote for all nominees for directors or may withhold authority to vote for certain nominees for directors. Broker non-votes are not considered for the purpose of the election of directors.

The ratification of the selection of Deloitte & Touche as the Company’s independent registered public accounting firm and the advisory (non-binding) proposal to approve the Company’s executive compensation each requires the affirmative vote of a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome on these matters.

Your vote will not be disclosed either within the Company or to third parties, except: (i) as may be necessary to meet applicable legal requirements or to assert or defend claims for or against the Company; (ii) to allow for the tabulation of votes and certification of the vote; and (iii) to facilitate a successful proxy solicitation.

Effect of Advisory Votes

The approval, on an advisory basis, of our executive compensation, also known as a “say on pay” vote, is an advisory vote mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”). This means that while we ask stockholders to approve our executive compensation, it is not an action that requires stockholder approval, and stockholders are not voting to approve or disapprove the Board’s recommendation with respect to this proposal. This advisory vote is non-binding on the Board, although the Board welcomes the input of our stockholders on the Company’s compensation policies and compensation program and will take the advisory vote into account in making determinations concerning executive compensation. At our 2023 annual meeting of stockholders held on July 20, 2023, we conducted a stockholder advisory vote on the frequency of future stockholders votes on the Company’s executive compensation (every one, two or three years), also known as a “say on frequency” vote. The Board considered the results of this “say on frequency” advisory vote and, since the most affirmative votes of all the votes cast on the “say on frequency” matter expressed a preference for having the “say on pay” vote every year, determined that an advisory vote on executive compensation would be conducted on an annual basis until the next vote on the frequency of such stockholder advisory votes. Notwithstanding the outcome of stockholder “say on frequency” votes, however, the Board may in the future decide to conduct advisory votes on a less frequent basis if appropriate and may vary its practice based on factors such as discussions with stockholders and the adoption of material changes to compensation programs.

| 5 |

Voting of Proxies

Stockholders of Record

As a stockholder of record, you will receive the Notice of Internet Availability by mail to notify you of the availability of these proxy materials on the Internet. As the stockholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the meeting.

Beneficial Owners

As a beneficial owner, you have the right to direct your broker, bank or nominee as to how to vote your shares. Please refer to the voting instruction card provided by your broker, bank or nominee. You are also invited to attend the Annual Meeting. However, because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote the shares at the meeting. Once you have received a legal proxy from your broker, bank or nominee, it should be emailed to paul.dell@powerfleet.com and should be labeled “Legal Proxy” in the subject line. Please include proof from your broker, bank or other nominee of your legal proxy (e.g., a forwarded email from your broker, bank or other nominee with your legal proxy attached, or an image of your legal proxy attached to your email). Requests for registration must be received by Computershare no later than 5:00 p.m., Eastern Time, on September 11, 2025.

Voting Without Attending the Meeting

Whether you hold shares directly as the stockholder of record or through a broker, bank or other nominee as the beneficial owner, you may direct how your shares are voted without attending the Annual Meeting. There are two ways to vote by proxy without attending the meeting:

| ● | By Internet — Stockholders of record may submit proxies over the Internet by following the instructions on the proxy card or voting instruction card. | |

| ● | By Mail — Stockholders of record may submit proxies by completing, signing and dating their proxy card or voting instruction card and mailing it in the accompanying pre-addressed envelope. |

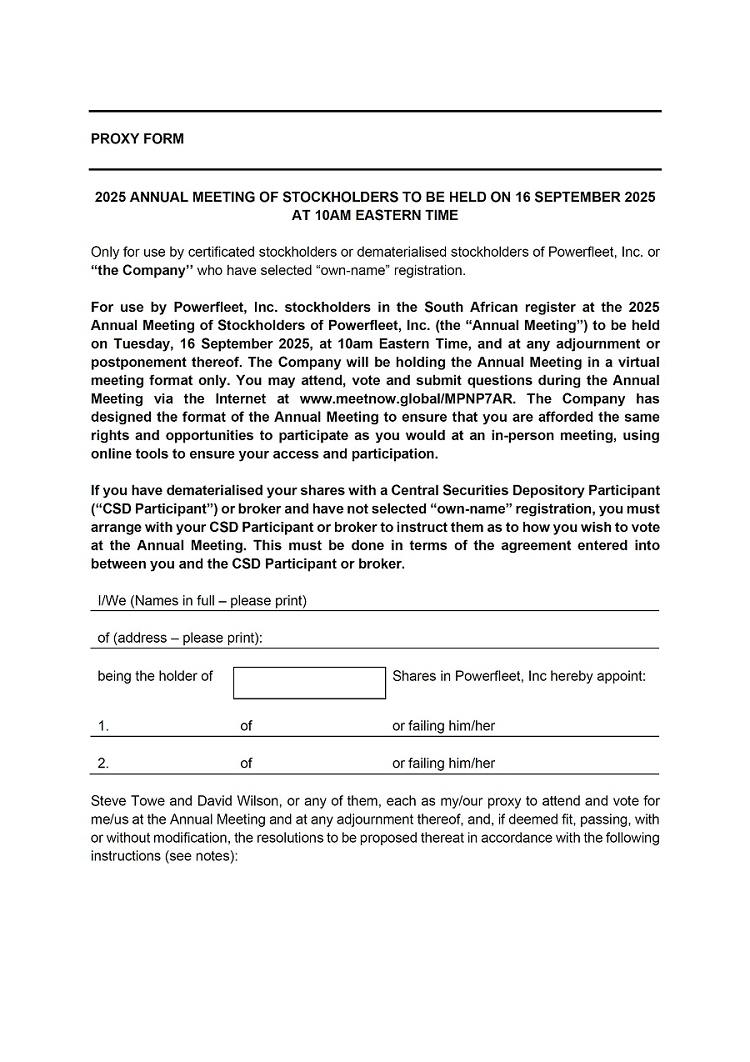

Stockholders on the South African Register

If you are a certificated stockholder or an “own-name” dematerialised stockholder registered on the South African register, you have the right to submit your vote directly to the Company or to vote virtually at the meeting via the Internet at www.meetnow.global/MPNP7AR. Even if you plan to attend and participate in the Annual Meeting, we strongly recommend that you vote your shares in advance, as described below, so that your vote will be counted if you subsequently decide not to attend the Annual Meeting. To vote in advance of the Annual Meeting, you should complete the South African proxy card (“SA proxy card”) and return it to the Company’s South African transfer agent, Computershare Investor Services Proprietary Limited (“Computershare SA”), by email to proxy@computershare.co.za or by mail or hand delivery to Computershare Investor Services Proprietary Limited, Rosebank Towers, 15 Biermann Avenue, Rosebank, 2196 (Private Bag X9000, Saxonwold, 2132) South Africa by 16:00, South African Time, on Friday, September 12, 2025.

If you are a dematerialised stockholder without “own-name” registration, you should not complete the SA proxy card. Instead, you should provide your CSDP or broker with your voting instructions or, alternatively, you should inform your CSDP or broker of your intention to attend the Annual Meeting in order for your CSDP or broker to be able to issue you with the necessary authorization to enable you to attend the Annual Meeting via the Internet at www.meetnow.global/MPNP7AR.

| 6 |

Revocation of Proxies

Stockholders can revoke a proxy prior to the completion of voting at the Annual Meeting through any of the following methods:

| ● | by writing a letter delivered to our Corporate Secretary, stating that the proxy is revoked; | |

| ● | by submitting another proxy bearing a later date; or | |

| ● | by attending the virtual Annual Meeting and voting virtually (unless you are a beneficial owner without a legal proxy, as described below). |

Please note, however, if you were not a registered stockholder of record, but held shares through a broker, bank or other nominee (i.e., in street name), you will need to obtain a “legal proxy” from the broker, bank or other nominee that holds your shares, confirming your beneficial ownership of the shares.

Stockholders on the South African Register

If you are a certificated stockholder or an “own-name” dematerialised stockholder, you can revoke your proxy by submitting another properly completed SA proxy card to Computershare SA as described above by 16:00, South African Time, on Friday, September 12, 2025.

If you are a dematerialised stockholder without own-name registration, you should provide your CSDP or broker to change your voting instructions by 16:00, South African Time, on Friday, September 12, 2025.

If you attend the Annual Meeting and vote online, this will revoke your proxy. Attending the meeting will not, by itself, revoke your proxy.

Solicitation

The cost of preparing, assembling, printing and mailing the proxy material and of reimbursing brokers, nominees and fiduciaries for the out-of-pocket and clerical expenses of transmitting copies of the proxy material to the beneficial owners of shares held of record by such persons will be borne by the Company.

| 7 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board has nominated Steve Towe, Michael Brodsky, Ian Jacobs, Andrew Martin and Michael McConnell for election as directors of the Company. If elected to the Board, each nominee will hold office until our Annual Meeting of Stockholders to be held in 2026 and until his respective successor has been duly elected and qualified, or until his earlier death, resignation or removal. Each of Messrs. Towe, Brodsky, Jacobs, Martin and McConnell has consented to being named as a nominee and, if elected, to serve as a director. The nominating committee of the Board (the “Nominating Committee”) and the Board believe that each of these nominees possesses the attributes we seek in directors generally as well as the individual experiences, qualifications and skills included in their individual biographies below.

If any nominee is unable to serve, which the Board has no reason to expect, the persons named in the proxy intend to vote for the balance of those nominees named above and, if they deem it advisable, for a substitute nominee.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF ALL OF THE DIRECTOR NOMINEES LISTED ABOVE.

Information About Our Directors, Director Nominees and Executive Officers

The table below sets forth the names and ages of the directors, nominees for director and executive officers of the Company as of July 25, 2025, as well as the position(s) and office(s) with the Company held by those individuals. A summary of the background and experience of each of those individuals is set forth after the table.

| Name | Age | Position(s) | ||

| DIRECTORS AND DIRECTOR NOMINEES: | ||||

| Steve Towe | 53 | Chief Executive Officer and Director | ||

| Michael Brodsky | 57 | Director and Chairman of the Board of Directors | ||

| Ian Jacobs | 48 | Director | ||

| Andrew Martin | 52 | Director | ||

| Michael McConnell | 59 | Director | ||

| EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS OR DIRECTOR NOMINEES: | ||||

| Melissa Ingram | 39 | Chief Corporate Development Officer | ||

| Michael Powell | 48 | Chief Innovation Officer | ||

| David Wilson | 57 | Chief Financial Officer and Corporate Secretary |

Directors and Director Nominees

Steve Towe. Mr. Towe has served as our Chief Executive Officer and a director of the Company since January 2022. Mr. Towe also serves on the board of directors of I.D. Systems, Inc. (“I.D. Systems”) and Powerfleet Israel Ltd., each of which is our wholly owned subsidiary. Mr. Towe has over 20 years of experience in senior leadership positions for global software companies and previously served as President and Chief Operating Officer of Aptos, Inc., a global leader of unified commerce solutions in the retailer enterprise SaaS market, from 2016 to December 2021. Mr. Towe has vast knowledge of the IoT industry, having served from 2011 to 2016, as the Chief Commercial Officer of Masternaut, a global telematics provider. Before his tenure at Masternaut, Mr. Towe served as Managing Director, from 2006 to 2011, and Director of Group Operations, from 2002 to 2006, of Cybit Ltd, a market consolidating data company, and was a founding member and senior executive of Fleetstar Information Systems, the fleet management subsidiary of the Trafficmaster Group, from 2001 to 2002. Mr. Towe’s early career was spent in numerous leadership roles for global retailer WH Smith.

| 8 |

Mr. Towe’s qualifications to serve on the Board include his years of experience scaling high value, global technology organizations. In addition, Mr. Towe’s role as our Chief Executive Officer provides the Board with invaluable insight into our management and daily operations.

Michael Brodsky. Mr. Brodsky has served as a director of the Company since June 2014, as Chairman of the Board since December 2016 and as a director of Pointer since October 2019. Previously, Mr. Brodsky was the Lead Director of the Board from June 2014 until December 2016. Mr. Brodsky is the President of Bosun Asset Management, LLC, an asset management firm, and he co-founded and was the Chief Executive Officer of Options Solutions, LLC, a specialized asset manager, until it was acquired by Bosun in October 2023. Mr. Brodsky is the Managing Partner of Vajra Asset Management, LLC, an investment firm. Mr. Brodsky has served on the board of directors of EdgeCortix Inc., a firm specializing in semi-conductor technology, since March 2021. Previously, Mr. Brodsky served on the board of directors of Genesis Land Development Corporation (OTCMKTS: GNLAF), a residential land developer and homebuilder, from 2012 to May 2019, including as Chairman from September 2012 to May 2019, on the board of directors of Determine, Inc. (formerly Nasdaq: DTRM), a provider of contract management, procurement and sourcing software, from October 2010 until its sale in April 2019, including as Chairman from August 2013 to April 2019 and as Chief Executive Officer from August 2013 until December 2013, on the board of directors of Trans World Corporation (formerly OTCQB: TWOC), an owner and operator of hotels and casinos throughout Europe, from September 2013 until its sale in March 2018, including as Chairman from June 2014 to March 2018, and on the board of directors of Spark Networks, Inc. (OTCMKTS: LOVLQ), a collection of niche-oriented community websites, from November 2015 until its sale in November 2017. Mr. Brodsky holds a B.A. degree from Syracuse University, an M.B.A. from the Kellogg School of Management at Northwestern University, and a J.D. from Northwestern University Pritzker School of Law.

Mr. Brodsky possesses extensive business, operating and executive expertise. Among other things, Mr. Brodsky has served as the Chief Executive Officer of several companies and possesses skills in executive management and leadership. We believe Mr. Brodsky’s management and leadership skills and experience as a member of the board of directors of various companies enable him to be an effective contributing member of the Board.

Ian Jacobs. Mr. Jacobs joined the Board upon consummation of the Company’s business combination (the “MiX Combination”) with MiX Telematics Limited (now MiX Telematics Proprietary Limited, “MiX Telematics”) on April 2, 2024. Mr. Jacobs has served as a director of MiX Telematics (formerly NYSE: MIXT) since 2016, including as Chairperson since November 2022. From 1997 to 2002, Mr. Jacobs worked as a research analyst at Schroders, Sidoti & Co. (now SIDOTI & Company) and Goldman Sachs & Co. In 2003, he joined Berkshire Hathaway Inc. where he worked on investment research and other projects under Warren Buffett until 2009. In 2009, Mr. Jacobs left Berkshire Hathaway Inc. to form 402 Capital LLC, a private investment firm, where he has since served as the managing member. Mr. Jacobs earned his undergraduate degree from Yeshiva University and an M.B.A. from Columbia University.

With his extensive experience with, and knowledge of the business and operations of, MiX Telematics and business experience with various investment firms, Mr. Jacobs brings a wealth of managerial and financial expertise to the Board. We believe Mr. Jacobs’ leadership skills, expertise in finance and investment, and insight into MiX Telematics’ business enable him to be an effective contributing member of the Board.

Andrew Martin. Mr. Martin joined the Board in April 2024. Mr. Martin serves as a Partner and member of the investment research team at Private Capital Management, LLC (“PCM”), an investment firm. Mr. Martin joined PCM in 2013 from the hedge fund unit at H.I.G. Capital, LLC, an alternative investment firm, where he was a senior research analyst focused primarily on industrials, business services and special situation investments. Mr. Martin previously was the Director of Research at Polen Capital Management, LLC, a global asset manager, where he helped develop and direct the firm’s research process. Mr. Martin has previously worked at Fine Capital Partners, Sanford C. Bernstein & Co., LLC, and Credit Suisse First Boston, as well as Arthur Andersen LLP, while earning a CPA license. He earned a B.S. degree in Applied Economics and Business Management from Cornell University and an M.B.A. from Columbia University.

With his extensive experience in investment research and serving in leadership roles at multiple investment firms, Mr. Martin brings substantial leadership and financial expertise to the Board. We believe Mr. Martin’s experience guiding long-term growth and navigating complex market dynamics enables him to be an effective contributing member of the Board.

| 9 |

Michael McConnell. Mr. McConnell joined the Board upon consummation of the MiX Combination on April 2, 2024. Mr. McConnell currently serves as Chairman of Adacel Technologies Limited, a developer of air traffic management systems and technology, and has served as a member of its board of directors since 2017. He also serves as a member of the board of directors of OneSpan Inc. (Nasdaq: OSPN), a provider of security, identity, e-signature and digital workflow solutions. Mr. McConnell has previously served on the boards of Vonage Holdings Corp. (formerly Nasdaq: VG), a cloud communications provider, from 2019 through its sale in July 2022, SPS Commerce, Inc. (Nasdaq: SPSC), a provider of cloud-based supply chain management services, from 2018 through 2019, Guidance Software, Inc. (formerly Nasdaq: GUID), a global provider of forensic security solutions, from April 2016 until the company was sold in 2017, and QuickFee, a provider of online payment and lending solutions. He has also served on numerous other public and private company boards in the United States, Australia, New Zealand and Ireland. Prior to his services as a board member of these public and private companies, Mr. McConnell served as the Managing Director of Shamrock Capital Advisors, a private investment company, for 14 years. Mr. McConnell holds a B.A. degree from Harvard University and an M.B.A. from the University of Virginia Darden School of Business.

Mr. McConnell possesses extensive management, operating, and financial expertise. We believe his more than two decades of experience serving in executive roles and on various public and private company boards in multiple industries enables Mr. McConnell to be an effective contributing member of the Board.

Executive Officers

Melissa Ingram. Ms. Ingram has served as our Chief Corporate Development Officer since April 2024. From March 2022 to April 2024, she served as our Chief Transformation Officer. Prior to joining the Company, Ms. Ingram worked at Aptos, Inc., serving as the Vice President of Transformation and Growth from October 2017 to January 2022 and the Vice President of Business Operations (EMEA) from October 2016 to October 2017. While at Aptos, Ms. Ingram led the integration of four acquisitions to expand portfolio areas and support entrance into new territories, standardized global operations, and spearheaded multi-million-dollar profit improvement programs. Ms. Ingram earned a Master of Arts (MA Oxon.) degree in Modern History from the University of Oxford.

Michael Powell. Mr. Powell has served as our Chief Innovation Officer since January 2025. Prior to joining Powerfleet, Mr. Powell held various senior leadership positions overseeing technology and innovation, including most recently serving as Chief Technology Officer of SEKO Logistics, a leader in end-to-end global logistics, from August 2018 to December 2024.

| 10 |

Steve Towe. See narrative description under the caption “Directors and Director Nominees” above.

David Wilson. Mr. Wilson has served as our Chief Financial Officer and Corporate Secretary since January 2023. Prior to joining the Company, Mr. Wilson served as the Chief Financial Officer of NSONE, Inc., a leading provider of next generation managed Domain Name System services, from May 2020 to December 2022. Additionally, Mr. Wilson has held Chief Financial Officer roles at Symphony Communication Services, LLC, an encrypted communication software company, from July 2017 to October 2019 and Ooyala Inc., a leading provider of online video services, from September 2013 to July 2017. Mr. Wilson earned a Bachelor of Commerce degree in Finance from the University of Birmingham.

CORPORATE GOVERNANCE AND BOARD MATTERS

General

Our Board is responsible for the management and direction of our Company and for establishing broad corporate policies. Members of the Board are kept informed of our business through various documents and reports provided by the Chief Executive Officer and other corporate officers, and by participating in Board and committee meetings. Each director has access to all of our books, records and reports, and members of management are available at all times to answer their questions.

Currently, there are five members of the Board. The Board is not classified or staggered, and all directors hold office until the next annual meeting of stockholders or until their respective successors are elected and qualified.

Director Independence

Our Board has determined that, with the exception of Mr. Towe, each of our current directors and director nominees satisfies the current “independent director” standards established by the Nasdaq rules and, as to the members of the audit committee of our Board (the “Audit Committee”), the additional independence requirements under applicable rules and regulations of the SEC. Thus, a majority of the Board is comprised of independent directors as required by the Nasdaq rules. The Audit Committee is composed of Messrs. Brodsky, Jacobs and McConnell, each of whom is an independent director in accordance with Nasdaq Rule 5605(c). The compensation committee of the Board (the “Compensation Committee”) is composed of Messrs. Brodsky, Jacobs, Martin and McConnell, each of whom is an independent director in accordance with Nasdaq Rule 5605(d). The Nominating Committee of the Board is composed of Messrs. Brodsky, Jacobs, Martin and McConnell, each of whom is independent in accordance with Nasdaq Rule 5605(e).

| 11 |

Board Leadership Structure

We currently separate the roles of the Chairman of the Board and Chief Executive Officer. Our Chief Executive Officer sets the strategic direction for the Company, working with the Board, and provides day-to-day leadership, while our Chairman leads the Board in the performance of its duties and serves as the principal liaison between the independent directors and the Chief Executive Officer. The separation of the roles of Chairman and Chief Executive Officer allows our independent Chairman to focus on governance of our Board, Board meeting agenda planning, Board committee responsibilities, investor engagement and outreach on governance matters, and our Chief Executive Officer to focus his attention on our business and execution of our Company’s strategy. While the Board believes that this leadership structure is the most effective for the Company at this time, it continues to evaluate the composition of the Board to determine what leadership structure is most appropriate for the Company and our stockholders.

Risk Oversight

The Board has the ultimate oversight responsibility for the risk management process and regularly reviews issues that present particular risk to us, including those involving competition, customer demands, economic conditions, planning, strategy, finance, sales and marketing, products, information technology, facilities and operations, supply chain, legal and environmental matters and insurance. The Board further relies on the Audit Committee for oversight of certain areas of risk management. In particular, the Audit Committee focuses on financial and enterprise risk exposures, including internal controls, and discusses with management and the Company’s independent registered public accounting firm our policies with respect to risk assessment and risk management, including risks related to fraud, liquidity, credit operations and regulatory compliance, and advises the internal audit function as to overall risk assessment of the Company.

| 12 |

While the Board oversees risk management, Company management is charged with managing risk. Management communicates routinely with the Board, committees of the Board and individual directors on significant risks that have been identified and how they are being managed. Directors are free to, and indeed frequently do, communicate directly with senior management.

The Company believes that its leadership structure, discussed above, supports the risk oversight function of the Board. The separation of the Chairman and Chief Executive Officer positions aids in the Board’s oversight of management, independent directors chair the various Board committees involved with risk oversight, there is frequent and open communication among management and directors, and all directors are actively involved in the risk oversight function. The Board believes that this approach provides appropriate checks and balances against undue risk-taking.

Board and Committee Meetings

For the fiscal year ended March 31, 2025, the Board held 20 meetings. Each director attended over 75% of the aggregate number of meetings of the Board and the meetings held by committees of the Board during the period in which such individual served as a director for the fiscal year. We encourage, but do not require, members of the Board to attend our annual meetings of stockholders.

Committees of the Board

The standing committees of the Board include the Audit Committee, the Compensation Committee and the Nominating Committee.

Audit Committee

The Audit Committee, which is a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is currently composed of Messrs. Brodsky, Jacobs and McConnell, each of whom is independent under Nasdaq Rule 5605(c)(2) and Rule 10A-3 under the Exchange Act.

The Board has determined that it has at least one “audit committee financial expert” serving on the Audit Committee. Mr. McConnell serves as the audit committee financial expert. Mr. McConnell also serves as the Chairman of the Audit Committee.

For the fiscal year ended March 31, 2025, the Audit Committee held 11 meetings.

The Board has adopted a written charter for the Audit Committee, a copy of which is publicly available on our website at https://ir.powerfleet.com/corporate-governance/governance-documents. The information on our website is not a part of this Proxy Statement. The Audit Committee’s charter sets forth the responsibilities, authority and specific duties of the Audit Committee and is reviewed and reassessed annually. The charter specifies, among other things, the structure and membership requirements of the Audit Committee, as well as the relationship of the Audit Committee to our independent registered public accounting firm and management.

In accordance with its written charter, the Audit Committee assists the Board in monitoring (i) the integrity of our financial reporting process including our internal controls regarding financial reporting, (ii) our compliance with legal and regulatory requirements, and (iii) the independence and performance of our internal and external auditors, and serves as an avenue of communication among the independent registered public accounting firm, management and the Board.

The report of the Audit Committee appears on page 19 of this Proxy Statement.

| 13 |

Compensation Committee

The Compensation Committee is currently composed of Messrs. Brodsky, Jacobs, Martin and McConnell, each of whom is independent within the meaning of Nasdaq Rule 5605(a)(2). Mr. Martin currently serves as the Chairman of the Compensation Committee. Mr. Brodsky served as the Chairman of the Compensation Committee until September 2024.

For the fiscal year ended March 31, 2025, the Compensation Committee held four meetings.

The Compensation Committee recommends to the Board for its approval our executive officers’ annual compensation and long-term incentives and option and other equity grants, reviews management’s performance, development and compensation, and administers our incentive plans. The Board has adopted a written charter for the Compensation Committee, a copy of which is publicly available on our website at https://ir.powerfleet.com/corporate-governance/governance-documents. The Compensation Committee’s charter sets forth the responsibilities, authority and specific duties of the Compensation Committee and is reviewed and reassessed annually. The charter specifies that the Compensation Committee has overall responsibility for evaluating and recommending to the Board for approval our director and officer compensation plans, policies and programs. The charter also specifies that the Compensation Committee may form and delegate authority to subcommittees of the Compensation Committee when appropriate; however, the Compensation Committee may not delegate authority to any other persons. As discussed below under “Compensation Discussion and Analysis,” for compensation decisions, the Compensation Committee considers recommendations relating to compensation for executive officers (other than our Chief Executive Officer, if any) from our Chief Executive Officer and includes him in its discussions with respect to such compensation, and considers compensation information provided by compensation consultants, if any, retained by the Compensation Committee for such purpose.

The Compensation Committee Process. Compensation Committee meetings typically involve a preliminary discussion with our Chief Executive Officer prior to the Compensation Committee deliberating without any members of management present. For compensation decisions, including decisions regarding the grant of equity compensation relating to executive officers (other than our Chief Executive Officer), the Compensation Committee considers the recommendations of our Chief Executive Officer and includes him in its discussions. The Compensation Committee may form and delegate authority to subcommittees of the Compensation Committee when appropriate.

Nominating Committee

The Nominating Committee is currently composed of Messrs. Brodsky, Jacobs, Martin and McConnell, each of whom is independent within the meaning of Nasdaq Rule 5605(a)(2). Mr. Jacobs serves as the Chairman of the Nominating Committee.

For the fiscal year ended March 31, 2025, the Nominating Committee did not hold any meetings.

The Board has adopted a written charter for the Nominating Committee, which is publicly available on our website at https://ir.powerfleet.com/corporate-governance/governance-documents. The Nominating Committee’s charter authorizes the committee to develop certain procedures and guidelines addressing certain nominating matters, such as procedures for considering nominations made by stockholders, minimum qualifications for nominees and identification and evaluation of candidates for the Board, and the Nominating Committee has adopted procedures addressing the foregoing.

| 14 |

Procedures for Considering Nominations Made by Stockholders. The Nominating Committee has adopted guidelines regarding procedures for nominations to be submitted by stockholders and other third parties, other than candidates who have previously served on the Board or who are recommended by the Board. These guidelines provide that a nomination must be delivered to our Secretary at our principal executive offices not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that if the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company. In no event will the public announcement of an adjournment, postponement or recess of an annual meeting commence a new time period (or extend any time period) for the giving of a notice as described above. The guidelines require a nomination notice to set forth as to each person whom the stockholder proposes to nominate for election as a director: (i) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to and in accordance with Section 14(a) of the Exchange Act, including a reasonably detailed description of all direct and indirect compensation and other material monetary agreements, arrangements or understandings during the past three years, as well as any other material relationships, between or among such stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made and its affiliates and associates, or others acting in concert therewith, on the one hand, and each proposed nominee and his or her affiliates, associates or others acting in concert therewith, on the other hand; (ii) such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected; (iii) all information with respect to such proposed nominee that would be required to be set forth in a stockholder’s notice as to any other business that a stockholder proposes to bring before the meeting, as set forth in our bylaws, if such proposed nominee were the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made; and (iv) a written representation and agreement (in the form provided by the Secretary upon written request) that the proposed nominee (1) is qualified and if elected intends to serve as a director of the Company for the entire term for which such proposed nominee is standing for election, (2) is not and will not become a party to (x) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how the proposed nominee, if elected as a director of the Company, will act or vote on any issue or question (a “Voting Commitment”) that has not been disclosed to the Company or (y) any Voting Commitment that could limit or interfere with the proposed nominee’s ability to comply, if elected as a director of the Company, with the proposed nominee’s fiduciary duties under applicable law, (3) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than the Company with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed therein, and (4) if elected as a director of the Company, the proposed nominee would be in compliance and will comply, with all applicable publicly disclosed corporate governance, ethics, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of the Company. The Nominating Committee’s policy is to consider all persons proposed to be nominated for election as a director in accordance with these procedures.

Qualifications. The Nominating Committee has adopted guidelines describing the minimum qualifications for nominees and the qualities or skills that are necessary for directors to possess. Each nominee:

| ● | must satisfy any legal requirements applicable to members of the Board; | |

| ● | must have business or professional experience that will enable such nominee to provide useful input to the Board in its deliberations; | |

| ● | must have a reputation, in one or more of the communities serviced by the Company and its affiliates, for honesty and ethical conduct; | |

| ● | must have a working knowledge of the types of responsibilities expected of members of the board of directors of a public company; and | |

| ● | must have experience, either as a member of the board of directors of another public or private company or in another capacity that demonstrates the nominee’s capacity to serve in a fiduciary position. |

We believe that each member of our Board should possess the qualities of character, judgment, business acumen, diligence, lack of conflicts of interest, familiarity with our business and industry, ability to work collegially and ability to act in the best interests of all stockholders. While we do not have a formal diversity policy, we seek to have directors representing a range of experiences, qualifications, skills and backgrounds.

| 15 |

Identification and Evaluation of Candidates for the Board. Candidates to serve on the Board will be identified from all available sources, including recommendations made by stockholders of the Company. The Nominating Committee has a policy that there will be no differences in the manner in which the Nominating Committee evaluates nominees recommended by stockholders and nominees recommended by the Nominating Committee or management, except that no specific process shall be mandated with respect to the nomination of any individuals who have previously served on the Board. The evaluation process for individuals other than existing members of the Board will include:

| ● | a review of the information provided to the Nominating Committee by the proponent; | |

| ● | a review of reference letters from at least two sources determined to be reputable by the Nominating Committee; and | |

| ● | a personal interview of the candidate, together with a review of such other information as the Nominating Committee shall determine to be relevant. |

Third Party Recommendations. With respect to the directors to be elected at the Annual Meeting, the Nominating Committee did not receive any nominations from any stockholder or group of stockholders which owned more than 5% of our common stock for at least one year.

Compensation of Directors

General

All directors are entitled to reimbursement for travel and lodging and other reasonable out-of-pocket expenses incurred by them in connection with their attendance at Board and/or Board committee meetings or other activities on our behalf.

Employee Directors

Directors who are current officers or employees of the Company or any subsidiary of the Company do not receive any additional compensation for their service as members of either the Board or any committees of the Board.

Non-Employee Directors

On May 16, 2024, the Board adopted a non-employee director compensation program pursuant to which non-employee directors are entitled to receive annual compensation having economic value of approximately $175,000, which includes a cash retainer of $87,500 and restricted stock grants with an economic value of approximately $87,500. The cash retainer may be paid, at each director’s election, in cash or in restricted shares of our common stock. Each of the non-employee directors was paid his retainer for fiscal year 2025 in cash. With respect to restricted stock awards, the number of shares issued in fiscal year 2025 was calculated based on the average of the reported closing price per share of our common stock on The Nasdaq Global Market over a 20 consecutive trading day period ending on and including the grant date for such awards, which was on May 16, 2024. Going forward, the number of shares issuable in any fiscal year will be calculated based on the average of the reported closing price per share of our common stock on The Nasdaq Global Market over a 20 consecutive trading day period ending on and including the date of that year’s annual meeting of stockholders.

Andrew Martin, a member of our Board, serves as a Partner and member of the research team at PCM, whose internal policies prohibit employees from receiving any direct compensation in connection with service on public company boards. As a result, we paid the cash compensation otherwise payable to Mr. Martin to PCM, and we issued to an affiliate of PCM a warrant to purchase 130,275 shares of common stock (the “PCM Warrant”) in lieu of granting equity compensation to Mr. Martin.

The Chairman of the Board and the chairperson of each of the committees of the Board are also entitled to a supplemental retainer, which may be paid, at each director’s election, in cash or in restricted shares of our common stock. Specifically, the Chairman of the Board receives an additional $36,000 per year; the chairperson of the Audit Committee receives an additional $18,000 per year; the chairperson of the Compensation Committee receives an additional $12,000 per year; and the chairperson of the Nominating Committee receives an additional $10,000 per year. Each of the non-employee directors was paid his supplemental retainer in fiscal year 2025 in cash.

During the fiscal year ended March 31, 2025, Michael Brodsky, Ian Jacobs, Andrew Martin and Michael McConnell were paid cash retainers in the aggregate amounts of $129,000, $97,500, $0 and $105,500, respectively. In addition, each of Messrs. Brodsky, Jacobs and McConnell received an award of (i) 18,028 in restricted shares of common stock, which were granted on May 16, 2024, and (ii) options to purchase 125,000 shares of common stock, which were granted on June 18, 2024, in consideration for such director becoming a director of the Company following the MiX Combination and pursuant to the Company’s 2018 Incentive Plan, as amended (the “2018 Plan”). All such restricted stock awards were scheduled to vest as to 100% of such shares on the first anniversary of the date of grant, provided that the non-employee director was then serving as a director of the Company. All such option awards have an exercise price of $4.31 per share and a term of 10 years, and are scheduled to vest in equal installments on the last day of each fiscal quarter over a period of 10 fiscal quarters following the date of grant, provided that the non-employee director is then serving as a director of the Company.

| 16 |

Our non-employee directors are not entitled to retirement, benefit or other perquisite programs.

The following table provides certain information with respect to the compensation paid to our non-employee directors during the fiscal year ended March 31, 2025.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | Option Awards ($)(4) | Total ($) | ||||||||||||

| Michael Brodsky | 129,500 | 98,253 | 332,407 | 560,160 | ||||||||||||

| Ian Jacobs | 97,500 | 98,253 | 332,407 | 528,160 | ||||||||||||

| Andrew Martin(5) | — | — | — | — | ||||||||||||

| Michael McConnell | 105,500 | 98,253 | 332,407 | 536,160 | ||||||||||||

| (1) | The amount under this column reflects the aggregate amount of cash retainers paid to each non-employee director. |

| (2) | The amounts under this column reflect the aggregate grant date fair value of 18,028 restricted shares of our common stock granted to each of Michael Brodsky, Ian Jacobs and Michael McConnell, under the 2018 Plan on May 16, 2024, each computed in accordance with ASC 718, disregarding any service-based vesting conditions. For a discussion of the assumptions we made in valuing the stock awards, see “Note 2[Q] – Summary of Significant Accounting Policies – Stock-based compensation” and “Note 9 – Stock-Based Compensation” in the notes to our consolidated financial statements contained in our Annual Report. The amounts set forth under this column do not include the restricted shares of common stock granted in lieu of cash for fees set forth under the column “Fees Earned or Paid in Cash.” Each of the restricted stock awards granted to Messrs. Brodsky, Jacobs and McConnell vested in full on May 16, 2025. |

| (3) | At March 31, 2025, each of Messrs. Brodsky, Jacobs and McConnell held 18,028 shares of unvested restricted stock. Mr. Martin did not hold any shares of unvested restricted stock. |

| (4) | At March 31, 2025, Mr. Brodsky held options to purchase 220,000 shares of our common stock, 145,000 of which were vested. Each of Messrs. Jacobs and McConnell held options to purchase 125,000 shares of our common stock, 50,000 of which were vested. Mr. Martin did not hold any options to purchase shares of our common stock at March 31, 2025. |

| (5) | Mr. Martin did not receive any compensation for his service as a director during the fiscal year ended March 31, 2025 and compensation otherwise payable to him was paid to PCM. |

Process for Sending Communications to the Board of Directors

The Board has established a procedure that enables stockholders to communicate in writing with members of the Board. Any such communication should be addressed and sent to our Corporate Secretary at c/o Powerfleet, Inc., 123 Tice Boulevard, Woodcliff Lake, New Jersey 07677. Any such communication must state, in a conspicuous manner, that it contains a stockholder communication and that it is intended for distribution to the entire Board or to one or more members of the Board, as applicable. All such stockholder communications will be forwarded to the director or directors to whom the communications are addressed. Under the procedures established by the Board, upon the Corporate Secretary’s receipt of such a communication, our Corporate Secretary will send a copy of such communication to each member of the Board or to the applicable director(s), identifying it as a communication received from a stockholder. Absent unusual circumstances, at the next regularly scheduled meeting of the Board held more than two days after such communication has been distributed, the Board will consider the substance of any such communication.

| 17 |

Code of Ethics

We have a code of ethics (the “Code of Ethics”) that applies to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Controller and Treasurer. A copy of our Code of Ethics can be found on our website at www.powerfleet.com. The Code of Ethics also is available in print, free of charge, to any stockholder who requests a copy by writing to the Company at the following address: Powerfleet, Inc., 123 Tice Boulevard, Woodcliff Lake, New Jersey 07677, Attention: Corporate Secretary. Our Code of Ethics is intended to be a codification of the business and ethical principles that guide the Company, and to deter wrongdoing, to promote honest and ethical conduct, to avoid conflicts of interest, and to foster full, fair, accurate, timely and understandable disclosures, compliance with applicable governmental laws, rules and regulations, the prompt internal reporting of violations and accountability for adherence to this code. We will post any amendment to the Code of Ethics, as well as any waivers that are required to be disclosed by the rules of the SEC or The Nasdaq Stock Market LLC, on our website.

Certain Relationships and Related Transactions

Our policy prohibits conflicts between the interests of our employees, officers and directors and our Company. A conflict of interest exists when an employee, officer, or director’s personal interest interferes or may interfere with the interests of the Company. When it is deemed to be in the best interests of our Company and our stockholders, the Audit Committee may grant waivers to employees, officers and directors who have disclosed an actual or potential conflict of interest, which waivers are subject to approval by our Board. This policy is included in our Code of Business Conduct and Ethics for Employees, Officers and Directors.

In accordance with its charter, the Audit Committee is responsible for annually reviewing any transactions or series of similar transactions to which we are or were a party and in which any director, executive officer or beneficial holder of more than 5% of any class of our voting securities, or members of any such person’s immediate family, have had or will have a direct or indirect material interest. Our Audit Committee’s procedures for reviewing related party transactions are not in writing. Since April 1, 2024, other than as described below, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which the Company is or was a party in which the amount involved exceeds $120,000 and in which any director, executive officer or beneficial holder of more than 5% of any class of our voting securities, or members of any such person’s immediate family, have had or will have a direct or indirect material interest. As of July 25, 2025, our common stock is the Company’s only class of voting securities.

On April 21, 2025, we issued the PCM Warrant, which contains the same vesting terms as the option awards granted to our non-employee directors, other than Andrew Martin, on June 18, 2024. Mr. Martin serves as a limited partner of such PCM affiliate. The Board approved and authorized the issuance of such warrant in lieu of granting stock options to Mr. Martin as compensation for his service as a director during the fiscal year ended March 31, 2025.

| 18 |

REPORT OF THE AUDIT COMMITTEE

The Report of the Audit Committee does not constitute soliciting material, and shall not be deemed to be filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date of this Proxy Statement and irrespective of any general incorporation language in those filings, except to the extent that the Company specifically incorporates the Report of the Audit Committee by reference therein.

The Audit Committee of the Board of Directors is currently comprised solely of independent directors meeting the requirements of applicable rules of the SEC and of The Nasdaq Stock Market LLC. All members of the Audit Committee were appointed by the Board. The Audit Committee operates pursuant to a written charter adopted by the Board. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis. As more fully described in the charter, the purpose of the Audit Committee is to provide general oversight of the Company’s financial reporting, integrity of financial statements, internal controls and internal audit functions.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles, and internal controls and procedures designed to ensure compliance with applicable accounting standards, laws and regulations. The Company’s independent registered public accounting firm, which was Deloitte & Touche for the fiscal year ended March 31, 2025, is responsible for performing an independent audit of the Company’s financial statements in accordance with standards of the Public Accounting Oversight Board (United States) (“PCAOB”) and expressing an opinion in its report on those financial statements.

The Audit Committee reviewed the Company’s audited financial statements for the year ended March 31, 2025 and met with both management and Deloitte & Touche to discuss those financial statements and Deloitte & Touche’s related opinion.

The Audit Committee has discussed with Deloitte & Touche the matters required to be discussed by Statement on Auditing Standards No. 1301, Communications with Audit Committees.

The Audit Committee has received and reviewed the written disclosures and the letter from Deloitte & Touche required by applicable requirements of the PCAOB regarding Deloitte & Touche’s communications with the Audit Committee concerning independence and has discussed with Deloitte & Touche its independence.

Based on its review and the meetings, discussions and reports described above, and subject to the limitations of its role and responsibilities referred to above and in its charter, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements of the Company for the fiscal year ended March 31, 2025, be included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2025 for filing with the SEC.

Members of the Audit Committee:

Michael

McConnell, Chairperson

Michael Brodsky

Ian Jacobs

| 19 |

EXECUTIVE COMPENSATION

A Message from the Powerfleet Compensation Committee

Dear Powerfleet Stockholders,

On behalf of Powerfleet’s entire Board of Directors and the members of the Compensation Committee, we thank you for your continued investment in our Company and your support of our management team during this transformational year. During the fiscal year ended March 31, 2025 (“fiscal 2025”), we completed the business combination with MiX Telematics and the acquisition of Fleet Complete, creating a scaled, global AI-powered fleet intelligence platform. As a result, our subscriber base has quadrupled to approximately 2.8 million, and our customer footprint has expanded to approximately 48,000 customers across more than 120 countries. Integration remains on track, with both cost and revenue synergies already contributing to results. Revenue grew to $362.5 million, a 26% increase on a pro forma basis, with recurring SaaS revenue accounting for approximately 75% of total revenue. Adjusted EBITDA increased 65% to $71 million, driving margin expansion to approximately 20%, and we realized approximately $16 million in annualized cost synergies.

As members of the Compensation Committee, we have taken a thoughtful approach to ensuring that our executive compensation program aligns with our business strategy, drives value for our stockholders and appropriately and effectively incentivizes and retains our executives during this transformational year. Further, our Compensation Committee carefully reviewed the “say-on-pay” voting results from our 2024 annual meeting of stockholders when considering executive compensation design for fiscal 2025. Since our 2024 annual meeting, Powerfleet appointed a new Compensation Committee chair, Mr. Martin, in September 2024, and the Compensation Committee, with advice from its independent third-party consultant, has led the:

| ● | Implementation of the fiscal 2025 Global Bonus Plan (“GBP”), which is earned based on achievement of performance goals tied to adjusted EBITDA, revenue and cash from organic operations. Based on our strong performance in fiscal 2025, our executives earned 100% of their target bonus. |

| ● | Creation of the fiscal 2025 annual long-term incentive plan (“LTIP”). The LTIP is performance-oriented and aligned with the Company’s pay-for-performance philosophy. 66.7% of each named executive officer’s (“NEO’s”) LTIP opportunity is allocated to performance-based restricted stock that vests based on achievement of goals tied to adjusted EBITDA, organic revenue growth and adjusted EBITDA margin. Due to ongoing integration of the MiX Telematics and Fleet Complete businesses during fiscal 2025, we delayed goal setting for the fiscal 2025 performance-based restricted stock awards to refine the long-term plan for the combined company and determined to measure performance for the final two fiscal years (fiscal 2026 and fiscal 2027) of the three-year restriction period. |

| ● | Enhancement of our proxy statement, including expanded content and formatting that go beyond our required “smaller reporting company” mandates, such as the inclusion of a detailed “Compensation Discussion & Analysis” section. |

| ● | Adjustments to our compensation peer group to better reflect the size and make-up of our organization. |

Each NEO’s fiscal 2025 target total direct compensation opportunity was set within a reasonable range of the market median. In fiscal 2025, to enhance retention and equity ownership, and to motivate our Chief Executive Officer (“CEO”) for superior shareholder value creation, Mr. Towe also received a one-time, performance-focused equity award. 75% of the award vests based on the achievement of volume-weighted average price hurdles, the highest of which is $10.00 per share, representing an 87% share price growth since March 31, 2024. Although this award was incremental to the CEO’s annual target opportunity, we believe it accomplishes the appropriate retention and performance objectives as Powerfleet enters its next chapter of growth, led by our CEO.

We are asking our stockholders to vote at the Annual Meeting in favor of the “say-on-pay” proposal (Proposal 3). The Compensation Committee continues to evolve the executive compensation program to align with good governance practices and incentivize the Company’s long-term strategic priorities. For fiscal 2026, the Compensation Committee will continue to allocate 66.7% of each NEO’s annual LTIP opportunity to performance-based restricted stock. Performance-based restricted stock will vest based on achievement of organic revenue growth, adjusted EBITDA, less stock-based compensation, per share growth, and relative total shareholder return, each measured over three years, with goals set at the beginning of the three-year performance period.

As a Compensation Committee, we remain focused on driving the thoughtful evolution of the Company’s executive compensation program in support of our business strategy, while taking into account the views of our stockholders. We will continue to focus on implementing clear and robust compensation programs that emphasize rewarding exceptional performance, driving value creation for our stockholders and ensuring sound governance.

Sincerely,

Andrew

Martin, Chair

Michael Brodsky, Member

Ian Jacobs, Member

Michael McConnell, Member

| 20 |

As we qualify as a “smaller reporting company” in accordance with Rule 12b-2 of the Exchange Act, we are permitted to comply with scaled-down executive compensation disclosure requirements, including not providing a Compensation Discussion and Analysis (“CD&A”) section in this proxy statement. In order to provide fulsome disclosure to our stockholders and in line with best practices, we have elected to include a CD&A but have relied on certain other disclosure relief applicable to smaller reporting companies, such as limiting the number of named executive officers subject to the disclosure and certain of the executive compensation tabular disclosure.

Compensation Discussion and Analysis

This discussion presents the principles underlying our executive officer compensation program. Our goal in this discussion is to provide the reasons why we award compensation as we do and to place in perspective the data presented in the tables that follow this discussion. The focus is primarily on compensation of our executive officers for the fiscal year ended March 31, 2025, but some historical and forward-looking information is also provided to put such year’s compensation information in context. The information presented herein relates to the following individuals who are considered “named executive officers” (“NEOs”) under applicable rules and regulations of the SEC. For fiscal 2025, our NEOs were:

| Name | Position | |

| Steve Towe | Chief Executive Officer (since January 5, 2022) | |

| David Wilson | Chief Financial Officer (since January 4, 2023) | |

| Melissa Ingram | Chief Corporate Development Officer (since April 2, 2024) |

| 2025 | Business Highlights |

| ● | Transformation Executed: Completed the business combination with MiX Telematics and the acquisition of Fleet Complete, creating a scaled, global AI-driven fleet-intelligence platform. Integration remained on schedule and early cost and revenue synergies contributed to fiscal 2025 results. |

| ● | Top-Line: Revenue was $362.5 million, up 26%; recurring SaaS revenue represented approximately 75% of total revenue. |

| ● | Profitability: Adjusted EBITDA increased 65% to $71 million, expanding margin to approximately 20%. |

| ● | Cash and Liquidity: Exited the year with adjusted liquidity (defined as cash and cash equivalents, plus undrawn revolver capacity, less unsettled transaction costs from our Fleet Complete acquisition) of $41.9 million, which was $1.8 million ahead of target. The $41.9 million excludes $10.0 million from our revolving credit facility with Bank Hapoalim B.M. secured in December 2024 (the “additional Hapoalim facility”). Realized approximately $16 million of annualized cost synergies, ahead of the original timetable. |

Overview of Executive Compensation Elements

The chart below summarizes the main elements of our executive compensation program and their purpose. Further detail on each of these compensation elements is provided in the sections that follow.

| Component | Objective | Design | ||

| Base Salary | Align base salaries to market to attract, retain and motivate executives. | Fixed pay (cash) based on individual skills, experience, responsibilities and performance over time. | ||

| Annual Cash Bonus | Motivate and reward our employees, including our NEOs, for meeting our short-term objectives using a pay-for-performance program with financial performance goals. | 100% based on financial performance paid only upon achievement of threshold goals:

● 50% tied to global adjusted EBITDA; ● 30% tied to global revenue; and ● 20% tied to cash position from organic operations.

| ||

| Annual Long-Term Incentive Program | Equity compensation intended to link our executive officers’ longer-term compensation with the performance of our stock and to build executive ownership. This promotes retention, motivates actions to maximize stockholder value, and links pay to financial results and stock price performance.

|

Newly added annual LTIP with:

● 66.7% of each NEO’s LTIP award consisted of performance-based restricted stock that vests based on the achievement of adjusted EBITDA, less stock-based compensation, growth rate in organic revenue, and adjusted EBITDA margin; and ● 33.3% of NEO’s LTIP award consisted of time-based restricted stock vesting in equal annual increments over a three-year period. |

Reflecting our key compensation principles, a significant portion of the targeted compensation opportunity that our NEOs receive is “at-risk” and dependent upon future financial and stock price performance. The majority of the target total direct compensation opportunity (excluding one-time bonuses and equity awards) for our NEOs, 87% for our CEO and 82% for our other NEOs, on average, is “at-risk” based on the achievement of pre-established performance goals and total shareholder return.

Consideration of the 2024 “Say-on-Pay” Vote

At our 2024 annual meeting of stockholders, 77.5% of the votes cast were in favor of an advisory vote to approve the compensation of our NEOs (the “2024 Say-on-Pay Vote”). Our Compensation Committee carefully reviewed the voting results of the 2024 Say-on-Pay Vote when considering executive compensation design for fiscal 2025, as well as other factors, including our long-term strategic plan and our ability to set longer term goals with precision during a transformative year. Since our 2024 annual meeting, Powerfleet appointed a new Compensation Committee chair, Mr. Martin, in September 2024, and the Compensation Committee, with advice from its independent third-party consultant, has led the:

| ● | Implementation of the fiscal 2025 GBP, which is earned based on achievement of performance goals tied to adjusted EBITDA, revenue and cash from organic operations. Based on performance in fiscal 2025, our executives earned 100% of their target bonus. | |