Exhibit 10.1

COMMITMENT LETTER

ATTENTION: David Wilson and Steven Blackhart

DATE: 14 December 2023

Dear Sirs,

Conditional Credit Committee Approval to provide a USD 85 million term funding package to Powerfleet Inc. for the purposes of repayment of the convertible preference share provided by Abry Partners (“Abry”) to Powerfleet inc. (“Term Facility”) and a ZAR 350m General Banking Facility (“GBF”) to Mix Telematics Limited (the “Borrowers”) (the “Transaction”).

1. COMMITMENT

| 1.1 | FIRSTRAND BANK LIMITED, THROUGH ITS RAND MERCHANT BANK DIVISION (“RMB”) is pleased to advise that conditional credit committee approval has been procured for the transaction, and RMB is accordingly in a position, subject to the conditions set out in paragraph 1.4 below, to provide the Borrowers with funding for the purposes of the Transaction up to the amounts set out in the table below (“Funding Commitment”): |

| Facility | Tranche | Tenor (yrs) | Committed Maximum Amount | Interest Rate | ||||

| Facility A | A | 3 | Up to USD 25m ZAR equivalent | 3m Jibar + 375 bps | ||||

| B | 5 | Up to USD 25m ZAR equivalent | 3m Jibar + 405 bps | |||||

| Facility B | C | 3 | USD 17.5m | SOFR + 450 bps | ||||

| D | 5 | USD 17.5m | SOFR + 500 bps | |||||

| General Banking Facility | 1 | ZAR 350m | ZAR Prime - 75 bps |

Detailed term sheets contain in Annexure 1 and 2.

| 1.2 | The Funding Commitment is based on the terms and conditions set out in the Term Sheet and subject to the additional terms and conditions set out in paragraph 1.3 below. | |

| 1.3 | The Commitment is subject to the following additional terms and conditions: |

| 1.3.1 | The Borrowers, accepting the Funding Commitment or a portion thereof, as applicable; | |

| 1.3.2 | negotiation, execution and delivery of the Finance Documents (in form and substance satisfactory to all parties thereto) and the fulfilment of any conditions precedent under the Finance Documents to our satisfaction; | |

| 1.3.3 | the merger transaction to be unconditional, with all relevant shareholder and regulatory approvals being evidenced; |

| 1.3.4 | it not being unlawful for us to make the Commitment, enter into the Finance Documents or otherwise participate in the Transaction as a Lender; | |

| 1.3.5 | the Authorised Dealer’s confirmation of Exchange Control approval for the proposed transaction; | |

| 1.3.6 | Confirmation that a notice of prepayment to Abry Partners has been acknowledged and accepted, and the repayment amount has been confirmed; | |

| 1.3.7 | completion all customary “anti-money laundering” and “know your customer” requirements that are required in connection with us advancing the Commitment in accordance with applicable laws; | |

| 1.3.8 | compliance with RMB’s internal transaction conclusion procedures; and | |

| 1.3.9 | the absence of any material adverse change or market disruption event which will make it undesirable for RMB to provide funding. |

2. FEES

Upon acceptance of the Commitment Letter, the Company shall pay a non-refundable upfront commitment fee in an amount equal to 0.15% of the Facility Amount of the Term Facility, which will be offsetable to the Non-Refundable Deal Structuring Fee of 1.00% of the Facility Amount. The fee is exclusive of any value-added tax or similar charge (“VAT”). The fee is due and payable in full upon signature of the Commitment Letter.

3. EFFECTIVENESS

| 3.1 | This commitment letter and other obligations under and in connection with the Commitment shall be effective only: |

| 3.1.1 | from the date on which the Borrowers, signs and accepts the terms and conditions set out in this commitment letter; and | |

| 3.1.2 | until the date falling on the earlier of: |

| 3.1.2.1 | the date on which Powerfleet advises us in writing that it declines the Commitment; | |

| 3.1.2.2 | the date on which the Finance Documents which relate to the Commitment are executed by all the parties thereto; and | |

| 3.1.2.3 | 30 April 2024. |

4. ENTIRE AGREEMENT

This letter sets out the full extent of the obligations in relation to the commitment to the Facilities until such time as RMB enters into the relevant Finance Documents. The terms of this letter and RMB’s obligations under this letter may only be amended or modified by written agreement between us.

5. GOVERNING LAW

This letter is governed by and construed in accordance with the laws of English Law.

SIGNED ON BEHALF OF FIRSTRAND BANK LIMITED, THROUGH ITS RAND MERCHANT BANK DIVISION ON 19 DECEMBER 2023.

| /s/ Blessings Magagane | /s/ Arun Varughese | |||

| Name: | Blessings Magagane | Name: | Arun Varughese | |

| Title: | Lead Banker: TMT Sector | Title: | Sector Head: TMT Sector | |

| Who warrants their authority | Who warrants their authority | |||

ACCEPTED BY POWERFLEET INC. AND MIX TELEMATICS LIMITED ON 19 DECEMBER 2023.

| /s/ David Wilson | |

| For and on behalf of | |

| POWERFLEET INC. | |

| /s/ Steven Blackhart | |

| For and on behalf of | |

| MIX TELEMATICS LIMITED |

ANNEXURE 1: TERM LOAN FACILITY

| Parties |

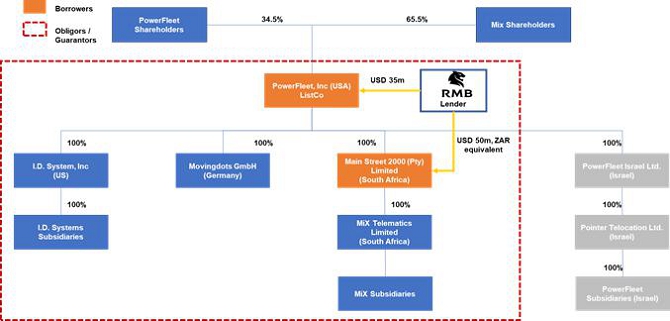

| Parent | PowerFleet, Inc. | |||

| Group | Parent and its Subsidiaries | |||

| Borrowers: | ● | Main Street 2000 (Pty) Limited for the ZAR portion; and | ||

| ● | PowerFleet, Inc for the USD portion | |||

| Guarantors: | On the Signing Date, the guarantors will consist of: | |||

| ● | PowerFleet, Inc (in respect of the other obligors); | |||

| ● | I.D. Systems, Inc and its subsidiaries; | |||

| ● | Movingdots GmbH and its subsidiaries; and | |||

| ● | Main Street 2000 (Pty) Limited and its subsidiaries (in respect of the other obligors) | |||

| The guarantees of the Guarantors will be joint and several obligations of the Guarantors. Each guarantee is a full and unconditional guarantee under the Facility. The guarantee of the Guarantors will rank pari passu with other Senior Indebtedness. | ||||

| Obligors: | The Borrowers and the Guarantors. | |||

| Borrower Group: | The Borrowers and its subsidiaries. | |||

| Mandated Lead Arranger | FirstRand Bank Limited, through its Rand Merchant Bank division (“RMB”) | |||

| Lender: | RMB | |||

| Security Agent: | RMB | |||

| Finance Party: | Means the Mandated Lead Arranger, the Security Agent and the Lender. | |||

Finance Document:

|

Means the Facility Agreement, any mandate letter, any fee letter, any Security document, any compliance certificate, any selection notice, any utilisation request, any other document designated as a “Finance Document” by the Borrower. | |||

FACILITY – TERM FACILITY

| Facility: | Dual-currency Senior Secured term loan facility (the “Term Facility”). | |||

| Amount: | Up to USD85 million (the “Facility Amount”) split between ZAR and USD. | |||

| ● | Facility A: USD 50 million (ZAR equivalent); and | |||

| ● | Facility B: USD 35 million. | |||

| Facilities | ● | Facility A | ||

| (i) | Tranche A (maturity date as below) | |||

| (ii) | Tranche B (maturity date as below) | |||

| ● | Facility B | |||

| (i) | Tranche C (maturity date as below) | |||

| (ii) | Tranche D (maturity date as below) | |||

| Purpose: | ● | To refinance existing indebtedness in Parent. | ||

| Ranking: | Senior, secured, ranking pari passu any other senior indebtedness of the Borrower (“Senior Indebtedness”). | |||

| Currency / Drawing: | ● | Facility A: To be denominated in South African Rands (“ZAR”) and will be available for drawing in ZAR. | ||

| ● | Facility B: To be denominated in United States Dollars (“USD”) and will be available for drawing in USD. | |||

| Signing Date: | The date of signing the Facility Agreement. | |||

| Effective Date: | The date on which all the Conditions Precedent for the Facility have been fulfilled, waived or deferred to the satisfaction of the Lender. | |||

| Final Maturity Date: | Tranche A: The date falling 36 months after the Signing Date or as extended per the Extension Option

Tranche B: The date falling 60 months after the Signing Date

Tranche C: The date falling 36 months after the Signing Date or as extended per the Extension Option

Tranche D: The date falling 60 months after the Signing Date | |||

| Repayment: | Bullet repayment on final maturity date. | |||

| Availability Period: | 30 days after Signature Date. | |||

| Utilisation: | Subject to the terms and conditions of the Term Facility the Borrower may, upon three Business Days’ (by no later than 10:00am London/Johannesburg time) give prior written notice to the Lender that it will make a drawing under the Term Facility. | |||

| Extension Option | At least 90 days prior to Original Maturity Date for Tranche A and Tranche C, the Borrower may request that the Lender extend the Original Maturity Date to the date falling 12 months from the Original Maturity Date (“First Extension Maturity Date”); and | |||

| At least 90 days prior to First Extension Maturity Date, the Borrower may request that the Lender extend the First Extension Maturity Date to the date falling 12 months from the First Extension Maturity Date (“Second Extension Maturity Date”), | ||||

| subject to terms and conditions stipulated by the Lenders including an internal credit approval, extension fee and agree Margin. | ||||

PRICING

| Non-Refundable Deal Structuring Fee: | 1.00% of the Facility Amount | |||

| ● | 0.15% payable upon receipt of credit approved Funding Commitment letter; and | |||

| ● | 0.85% payable within three (3) Business Days of the Closing Date. | |||

| Margin: | ● | Facility A | ||

| (i) | Tranche A: 3.75% | |||

| (ii) | Tranche B: 4.05% | |||

| ● | Facility B | |||

| (i) | Tranche C: 4.50% | |||

| (ii) | Tranche D: 5.00% | |||

| Interest on Loans: | The aggregate of the applicable: | |||

| Facility A | ||||

| ● | Margin; and | |||

| ● | JIBAR (market standard fallback provisions for the transition to Zaronia are to be included). | |||

| Facility B | ||||

| ● | Margin; and | |||

| ● | Term SOFR. | |||

| Interest Period | Interest Periods will be of 3 months or any other period agreed between the Borrower and the Lender, provided that no Interest Period may end after the Maturity Date. | |||

| Default Interest: | 2.0% p.a. above the applicable interest rate (with respect to overdue amounts only). | |||

| Term SOFR: | The Term SOFR reference rate administered by CME Group Benchmark Administration Limited (or any other person which takes over the administration of that rate) for the relevant period published by CME Group Benchmark Administration Limited (or any other person which takes over the publication of that rate) | |||

| Reference Rate | means, in relation to any Term SOFR Loan: (a) the applicable Term SOFR as of the Quotation Day, prior to 8.30am (New York Time) and for a period equal in length to the Interest Period of that Term SOFR Loan; or | |||

| (b) as otherwise determined pursuant to Unavailability of Term SOFR, and if, in either case, that rate is less than zero, the Reference Rate shall be deemed to be zero. | ||||

OTHER TERMS

| Security: | Security package to include: | |||

| (a) | Pledge and cession of shares in Obligors; and | |||

| (b) | Reversionary rights over existing security | |||

| Voluntary Prepayment and Cancellation: | Voluntary prepayments and cancellations may be made on three Business Days’ notice, minimum amount of USD 5,000,000 (ZAR equivalent). Voluntary Prepayments can only be made, without penalty, from operating cashflows for all Facilities or, with respect to Facility B, also from equity injections during the first 2 years. Thereafter, all Facilities may be refinanced by new lenders, operating cash flows, or equity injections. | |||

| Mandatory Prepayment and Cancellation | ● | Illegality | ||

| ● | Change of Control | |||

| ● | Delisting of Parent | |||

| ● | Sanctions | |||

| Right of Prepayment and Cancellation: | ● | Increased Costs, Tax Gross Up and Tax Indemnity | ||

| ● | Voluntary Cancellation | |||

| Representations/ Information Undertakings/ Events of Default: | Each Obligor will make, inter-alia, each of the following representations on the date of the Agreement on behalf of itself and where required on behalf of each member of its Group: | |||

| a) | status | |||

| b) | binding obligations | |||

| c) | non conflict with other obligations | |||

| d) | power and authority | |||

| e) | validity and admissibility in evidence | |||

| f) | governing law and enforcement | |||

| g) | no deduction of tax | |||

| h) | no filing or stamp taxes | |||

| i) | no default | |||

| j) | no insolvency | |||

| k) | no misleading information | |||

| l) | financial statements | |||

| m) | pari passu ranking | |||

| n) | no proceedings pending or threatened | |||

| o) | immunity | |||

| p) | adverse consequences | |||

| q) | no breach of laws | |||

| r) | environmental laws | |||

| s) | taxation | |||

| t) | anti-corruption and sanctions | |||

| u) | security and financial indebtedness | |||

| Financial Undertakings: | In respect of the Borrower: | |||

| ● | the ratio of Net Debt to EBITDA =< 2.5x from year 1, then =< 2.20x thereafter; and | |||

| ● | Interest Cover Ratio => 3.5x | |||

| Tested quarterly on a rolling 12-month basis. The first covenant test will occur on the third full quarter after the Closing Date. | ||||

| Distribution Covenants | In respect to the Obligor Group, distribution of any dividends to shareholders will only be permitted if: | |||

| ● | It has achieved Gross Debt to EBITDA ratio of less than 2.0x in the last 12 months; and | |||

| ● | Based on its forecasts, it also expects to meet this covenant in the next 12 months following distribution. | |||

| General Undertakings: | Undertakings, including others standard to a facility of this nature, will be included in the Agreement in respect of each Obligor and, where applicable, in relation to the relevant Group: | |||

| a) | authorisations | |||

| b) | compliance with laws | |||

| c) | negative pledge | |||

| d) | restrictions on borrowings in Material Subsidiaries | |||

| e) | restriction on disposals subject to agreed exceptions | |||

| f) | restriction on merger | |||

| g) | no distributions may be made without complying with the Distribution Covenants | |||

| h) | restriction on distributions to entities outside the Obligor Group | |||

| i) | no further financial indebtedness may be incurred without Lender consent | |||

| j) | pari passu ranking | |||

| k) | no change of business | |||

| l) | sanctions and anti-corruption laws | |||

| m) | environmental compliance | |||

Accounting Principles:

|

In relation to each member of the Borrower Group, the generally accepted accounting principles in its jurisdiction of incorporation, including (if applicable) IFRS and, for the avoidance of doubt, the implementation of IFRS 16 (Leases) and any successor standard thereto (or any equivalent measure under such generally accepted accounting principles). | |||

Transfers and Assignments:

|

A Lender may assign any of its rights or transfer by novation any of its rights and obligations to another bank or financial institution or to a trust, fund or other entity which is regularly engaged in or established for the purpose of making, purchasing or investing in loans, securities or other financial assets.

The consent of the Borrower will not be required. | |||

| Miscellaneous Provisions: | The Facility Agreement will contain market standard provisions relating to, among others, defaulting lender, market disruption, breakage costs (excluding loss of margin), tax gross-up and indemnity, sanctions, anti-bribery, anti-corruption, anti-money laundering, FATCA, bail-in, QFC, agency and administrative parties, increase costs with ability to substitute or repay lenders at par and lenders’ set-off. | |||

| Conditions Precedent: | These will include, but not limited to, the following in relation to each Obligor in form and substance satisfactory to the Lender: | |||

| a) | evidence of all relevant regulatory approvals | |||

| b) | constitutional documents | |||

| c) | resolution of board of directors of each Obligor | |||

| d) | specimen signatures | |||

| e) | shareholder resolutions of each Obligor to the extent required | |||

| f) | borrowing/guaranteeing certificate as required by the Companies Act | |||

| g) | certification of copy documents | |||

| h) | legal opinions of Lenders’ advisors addressing enforceability of the agreement | |||

| i) | requisite legal opinions of Borrower’s advisors with respect to the Borrower and each Guarantor | |||

| j) | evidence of process agent | |||

| k) | a copy of any other document, authorisation, opinion or assurance specified by the Lender | |||

| l) | financial statements relating to the Borrower and each Obligor | |||

| m) | evidence of payment of all fees, costs and expenses then due from the Borrower under the Agreement | |||

| n) | evidence that an off-shore account has been opened with the Off-shore Account Bank | |||

| o) | other documents and evidences as may be required. | |||

| Disclosure: | Including, subject to appropriate confidentiality arrangements, disclosure of confidential information by any Finance Party to: | |||

| (i) | any Affiliate of such Finance Party (together with such Finance Party, the “Permitted Parties”); | |||

| (ii) | professional advisers, auditors insurers, insurance brokers and service providers of a Permitted Party who are under a duty of confidentiality to a Permitted Party; | |||

| (iii) | whom information is required to be disclosed by any court or tribunal of competent jurisdiction or any governmental or regulatory authority or similar body, or pursuant to any applicable law or regulation; | |||

| (iv) | any actual or potential participant, sub-participant assignee or other transferee in relation to a Finance Party’s rights and/or obligations under any agreement (or any of its agents or professional advisers); and | |||

| (v) | any rating agency or direct or indirect provider of credit protection to a Permitted Party (or its brokers). | |||

| Costs and Expenses | All costs and expenses (including legal fees) reasonably incurred by the Lender and the Mandated Lead Arrangers in connection with the preparation, negotiation, printing, execution and syndication of the Agreement and any other document referred to in it shall be paid by the Borrower promptly on demand whether or not the Agreement is signed. | |||

| Lender rights | ● | Pre-emptive on all of the hedging requirements of the Facility. | ||

| ● | Pre-emptive on all the FX flows and spot trades of the Obligor Group, to the extent possible. | |||

| ● | Transactional Banking | |||

| Governing law and jurisdiction: | Facility to be documented under a single English law facility agreement with the courts of England having jurisdiction.

Security and Guarantees to be documented under English law with the courts of England having jurisdiction. Other local applicable law where appropriate or advised. | |||

aNNEXURE 2: GENERAL BANKING FACILITY

| Parent | PowerFleet, Inc. | |||

| Group | Parent and its Subsidiaries | |||

| Borrower: | Main Street 2000 (Pty) Limited | |||

| Guarantors: | On the Signing Date, the guarantors will consist of: | |||

| ● | PowerFleet, Inc (in respect of the other obligors); | |||

| ● | I.D. Systems, Inc and its subsidiaries; | |||

| ● | Movingdots GmbH and its subsidiaries; and | |||

| ● | Main Street 2000 (Pty) Limited and its subsidiaries (in respect of the other obligors) | |||

| The guarantees of the Guarantors will be joint and several obligations of the Guarantors. Each guarantee is a full and unconditional guarantee under the Facility. The guarantee of the Guarantors will rank pari passu with other Senior Indebtedness. | ||||

| Obligors: | The Borrowers and the Guarantors. | |||

| Borrower Group: | The Borrowers and its subsidiaries. | |||

| Mandated Lead Arranger | FirstRand Bank Limited, through its Rand Merchant Bank division (“RMB”) | |||

| Lender: | RMB | |||

| Security Agent: | RMB | |||

| Finance Party: | Means the Mandated Lead Arranger, the Security Agent and the Lender. | |||

Finance Document:

|

Means the Facility Agreement, any mandate letter, any fee letter, any Security document, any compliance certificate, any selection notice, any utilisation request, any other document designated as a “Finance Document” by the Borrower. | |||

FACILITY – GENERAL BANKING FACILITY

| Facility: | Committed 365-day General Banking Facility (“GBF”) | ||

| Amount: | Up to R350 million | ||

| Purpose: | General corporate and working capital purposes | ||

| Ranking: | Senior, secured, ranking pari passu any other senior indebtedness of the Borrower (“Senior Indebtedness”). | ||

| Signing Date: | The date of signing the Facility Agreement. | ||

| Effective Date: | The date on which all the Conditions Precedent for the Facility have been fulfilled, waived or deferred to the satisfaction of the Lender | ||

| Final Maturity Date: | 365 days | ||

| Repayment: | On demand. A date specified by the Lender to the Borrower, by way of written notice | ||

| PRICING | |||

| Non-Refundable Deal Structuring Fee: | 0.50% | ||

| Interest Rate | South African PRIME minus 0.75% | ||

| Commitment Fee (excluding VAT) | Applicable Commitment Fee tiered based on utilisation levels: | ||

| Utilisation | Commitment Fee (%) | ||

| 0 – 40% | 0.85% | ||

| 40.1% – 80% | 0.65% | ||

| Over 80% | 0.45% | ||

| The Commitment Fee is calculated on a day-to-day basis on the undrawn and uncancelled portions of the GBF, payable on the last day of each month. | |||

| Default Interest: | 2.0% p.a. above the applicable interest rate (with respect to overdue amounts only). | ||

OTHER TERMS

| Security: | Security package to include: | |||

| (c) | Pledge and cession of shares in Obligors; and | |||

| (d) | Reversionary rights over existing security | |||

| Mandatory Prepayment and Cancellation | ● | Illegality | ||

| ● | Change of Control | |||

| ● | Delisting of Parent | |||

| ● | Sanctions | |||

| Right of Prepayment and Cancellation: | ● | Increased Costs, Tax Gross Up and Tax Indemnity | ||

| ● | Voluntary Cancellation | |||

| Representations/ Information Undertakings/ Events of Default: | Each Obligor will make, inter-alia, each of the following representations on the date of the Agreement on behalf of itself and where required on behalf of each member of its Group: | |||

| a) | status | |||

| b) | binding obligations | |||

| c) | non conflict with other obligations | |||

| d) | power and authority | |||

| e) | validity and admissibility in evidence | |||

| f) | governing law and enforcement | |||

| g) | no deduction of tax | |||

| h) | no filing or stamp taxes | |||

| i) | no default | |||

| j) | no insolvency | |||

| k) | no misleading information | |||

| l) | financial statements | |||

| m) | pari passu ranking | |||

| n) | no proceedings pending or threatened | |||

| o) | immunity | |||

| p) | adverse consequences | |||

| q) | no breach of laws | |||

| r) | environmental laws | |||

| s) | taxation | |||

| t) | anti-corruption and sanctions | |||

| u) | security and financial indebtedness | |||

| General Undertakings: | Undertakings, including others standard to a facility of this nature, will be included in the Agreement in respect of each Obligor and, where applicable, in relation to the relevant Group: | |||

| a) | authorisations | |||

| b) | compliance with laws | |||

| c) | negative pledge | |||

| d) | restrictions on borrowings in Material Subsidiaries | |||

| e) | restriction on disposals subject to agreed exceptions | |||

| f) | restriction on merger | |||

| g) | no distributions may be made without complying with the Distribution Covenants | |||

| h) | restriction on distributions to entities outside the Obligor Group | |||

| i) | no further financial indebtedness may be incurred without Lender consent | |||

| j) | pari passu ranking | |||

| k) | no change of business | |||

| l) | sanctions and anti-corruption laws | |||

| m) | environmental compliance | |||

| Conditions Precedent: | These will include, but not limited to, the following in relation to each Obligor in form and substance satisfactory to the Lender: | |||

| a) | evidence of all relevant regulatory approvals | |||

| b) | constitutional documents | |||

| c) | resolution of board of directors of each Obligor | |||

| d) | specimen signatures | |||

| e) | shareholder resolutions of each Obligor to the extent required | |||

| f) | borrowing/guaranteeing certificate as required by the Companies Act | |||

| g) | certification of copy documents | |||

| h) | legal opinions of Lenders’ advisors addressing enforceability of the agreement | |||

| i) | requisite legal opinions of Borrower’s advisors with respect to the Borrower and each Guarantor | |||

| j) | evidence of process agent | |||

| k) | a copy of any other document, authorisation, opinion or assurance specified by the Lender | |||

| l) | financial statements relating to the Borrower and each Obligor | |||

| m) | evidence of payment of all fees, costs and expenses then due from the Borrower under the Agreement | |||

| n) | evidence that an off-shore account has been opened with the Off-shore Account Bank | |||

| o) | other documents and evidences as may be required. | |||

| Costs and Expenses | All costs and expenses (including legal fees) reasonably incurred by the Lender and the Mandated Lead Arrangers in connection with the preparation, negotiation, printing, execution and syndication of the Agreement and any other document referred to in it shall be paid by the Borrower promptly on demand whether or not the Agreement is signed. | |||

| Lender rights | ● | Pre-emptive on all of the hedging requirements of the Facility. | ||

| ● | Pre-emptive on all the FX flows and spot trades of the Obligor Group, to the extent possible. | |||

| ● | Transactional Banking | |||

| Governing law and jurisdiction: | South African Law / South Africa | |||